Below is a report we sent to clients on March 1st assessing the situation with Chinese corn stockpiling and potential market impacts. With Tuesday’s announcement of the end of the storage program it seems a good time to share this analysis

_________________________________________________________________________________________

AgTraderTalk Research: Impacts of China’s potential corn policy changes

March 1st, 2016

The big theme to watch in China right now is the potential change in the corn price policy. The latest announcements are that the new policies will come out “soon” in order to be released before spring planting. There isn’t much clarity on what will actually happen and if they will cut the reserve price again or make some other changes to the policy. China has tried some different subsidy programs with smaller crops where the government covers the difference between the market price and a higher reference price but these have been expensive and difficult to manage. Given the large size of the corn crop I think it’s more likely to see a reserve price cut vs a subsidy program, but again it’s very difficult to say.

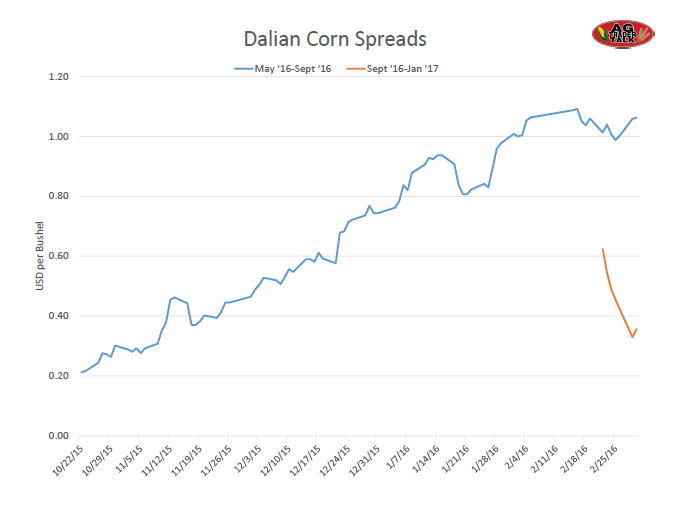

The futures market continues to price this in with the large spread between the May and September Dalian corn contracts, now trading at $1.06/bushel inverse. It’s also notable that the spread between the September and January contract has come in substantially to only a $0.36 inverse now. Maybe the talk that the reforms will be announced this spring has kept May/Sept at high levels, while weakening Sept-Jan.

Despite the large production and ending stocks, China has mostly been isolated from the international corn market. This has been increasing in recent years due to the rejections of US corn and reliance mostly on Ukraine imports. As I mentioned last month although China isn’t importing US corn their high domestic corn price indirectly support other alternative feeds like sorghum, barley, DDGS, cassava, etc… Imports of these could become less attractive if Chinese corn prices fall. And this would indirectly put pressure on feed grains, including corn.

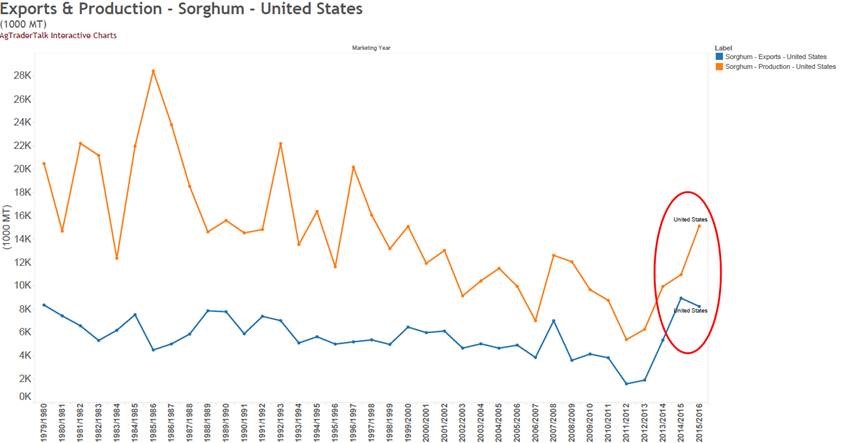

We’ve seen this to some extent with the 15/16 sorghum balance sheet in the US as production increases outpaced export increases. Sorghum production went from 433mbu in 14/15 to 597mbu in 15/16 while exports went from 353mbu to 325mbu. During that same time period Gulf basis for sorghum went from $1.90 to $0.10. So if this happens on a larger scale there will be a lot of feed grain without a buyer and it will need to compete with corn on price.

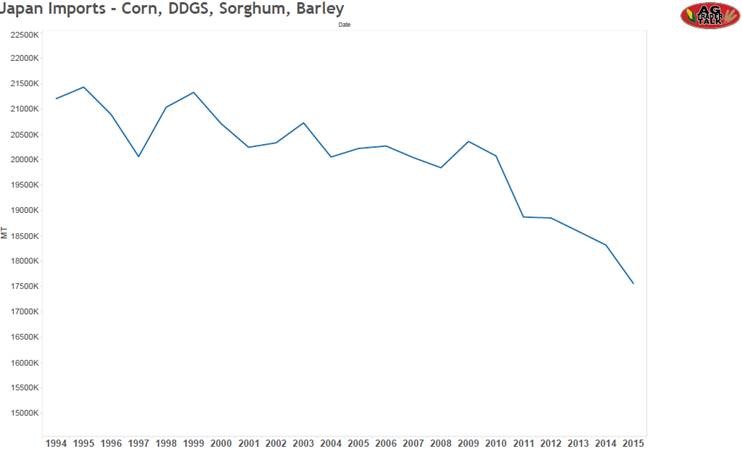

Another example of how this might play out is to look at the situation with Japan. Combined imports of corn, sorghum, DDGS and barley have been falling in recent years.

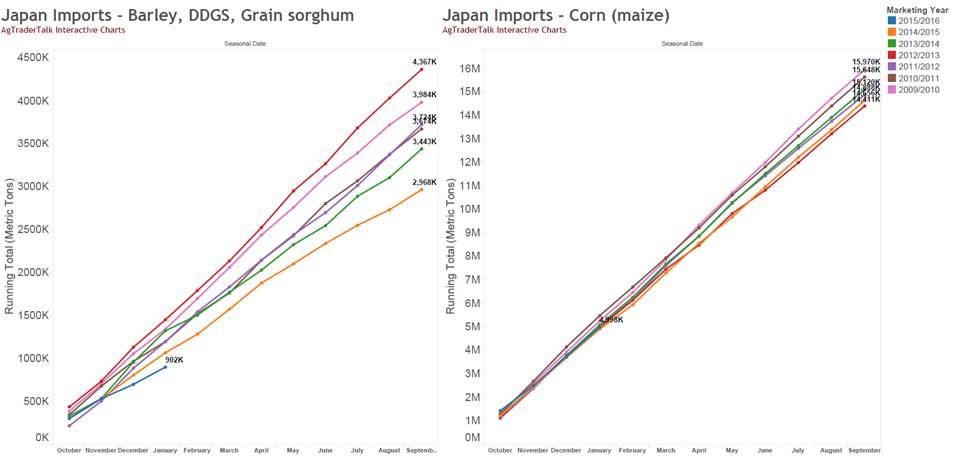

Japan’s marketing year to date corn imports are at 5.0 MMT vs 4.9 MMT last year. However the cumulative import pace of barley/sorghum/DDGS is very low at only 902k MT this marketing year. I’ve included those combined imports on the chart on the left below. Combined barley/sorghum/DDGS exports of 902k MT is the slowest pace since 1988 so this is relatively unprecedented.

USDA attaché noted recently that Japan had difficulty buying sorghum and barley due to China buying most of the exportable supplies from the US and Australia. We’ve seen a similar situation with DDGS where strong buying from China reduces exports to Japan. This has led to the lowest sorghum inclusion in feed on record (3.14%) , and the lowest barley inclusion in feed in 7 years (3.37%). To offset this inclusions of rice have increased, and corn inclusion has gone from 44.04% (10.69 MMT) in 11/12 to 45.04% (10.53 MMT) in 14/15. So although since 11/12 Japanese feed production has fallen 3.6%, the use of corn in feed has only fallen 1.5%.

If Chinese corn prices were lower they wouldn’t have been buying barley and sorghum as aggressively. This would mean Japan would be buying their normal mix of feed ingredients, and with decreasing feed production this would mean importing even less corn. This would in turn be more negative for the US corn export situation.

Lastly there were months in 2015 where DDGS exports to China accounted for nearly half of total DDGS production. DDGS imports are a loophole to get around the import controls on corn and are supported by the high domestic price. And due to their high domestic corn prices, China was able to buy DDGS at higher prices than other countries were. This helped support ethanol margins, and as a result, corn demand.

So although China isn’t very involved in the world corn market these policy changes will work their way through the system and would be negative to grain prices depending on how much the domestic prices fall. Unfortunately we don’t have much clarity on the scope or the timing of these changes.

03-01-2016 11-10 AM – AgTraderTalk Research Impacts of China’s potential corn policy changes (1)