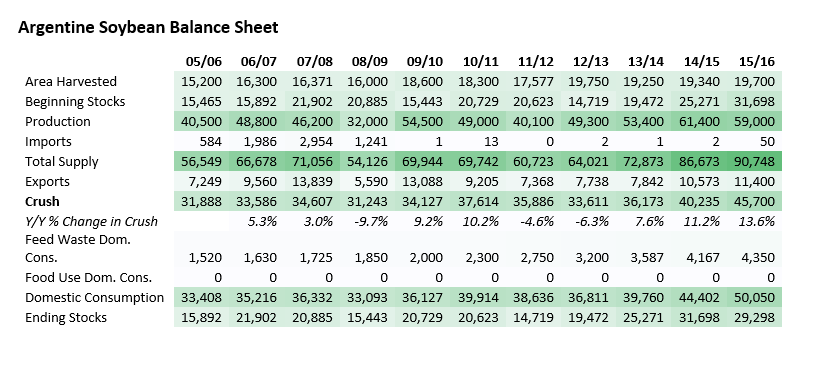

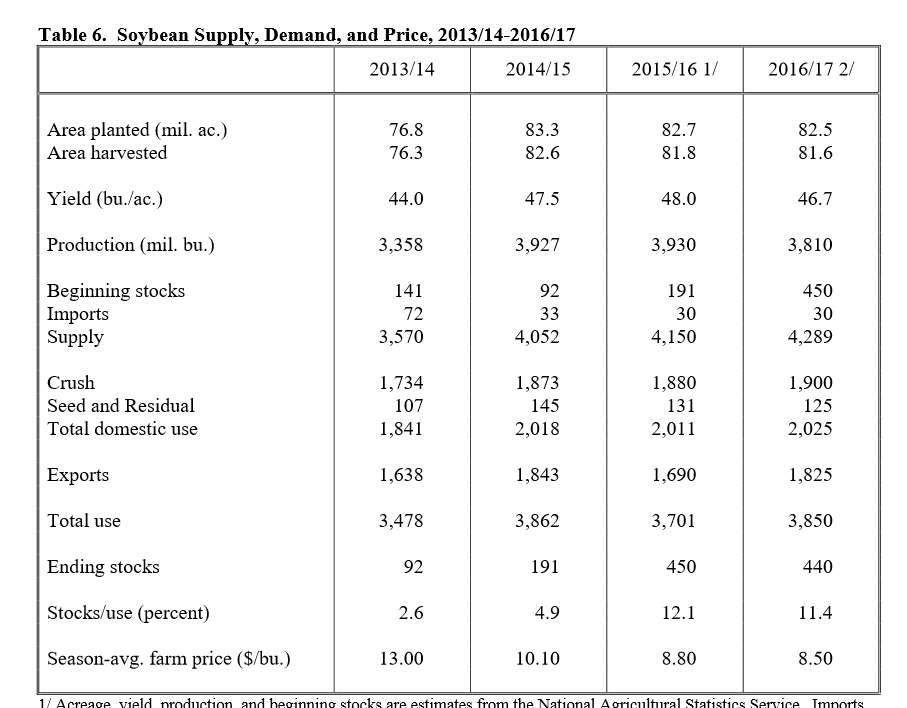

USDA is currently forecasting Argentine soybean crush for the 15/16 marketing year at 45.7 MMT. This is up compared to last year at 40.235 MMT and represents an increase of 13.6% which is the largest year-over-year increase in the past decade. This increase is due to the large production estimate of 59.0 MMT and also the record beginning stocks which are estimated at 31.698 MMT. Beginning stocks and production bring total supply to a record 90.748 MMT. For comparison Brazil’s total 15/16 supply is 119.803 MMT (100 MMT of production and 19.503 MMT of beginning stocks).

Soybean crush in 15/16 would represent 91.7% of Argentina’s domestic demand for soybeans compared to an average of 93.3% since 2005. Crush demand is also 4x larger than export demand which is at 11.4 MMT.

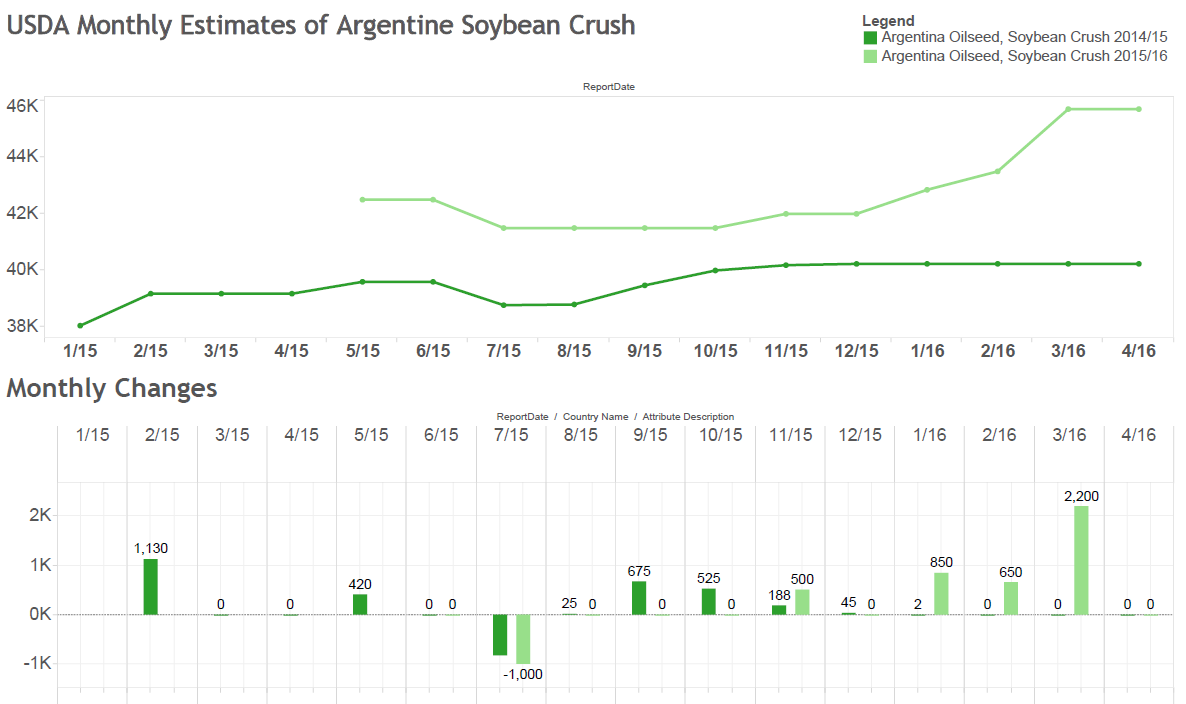

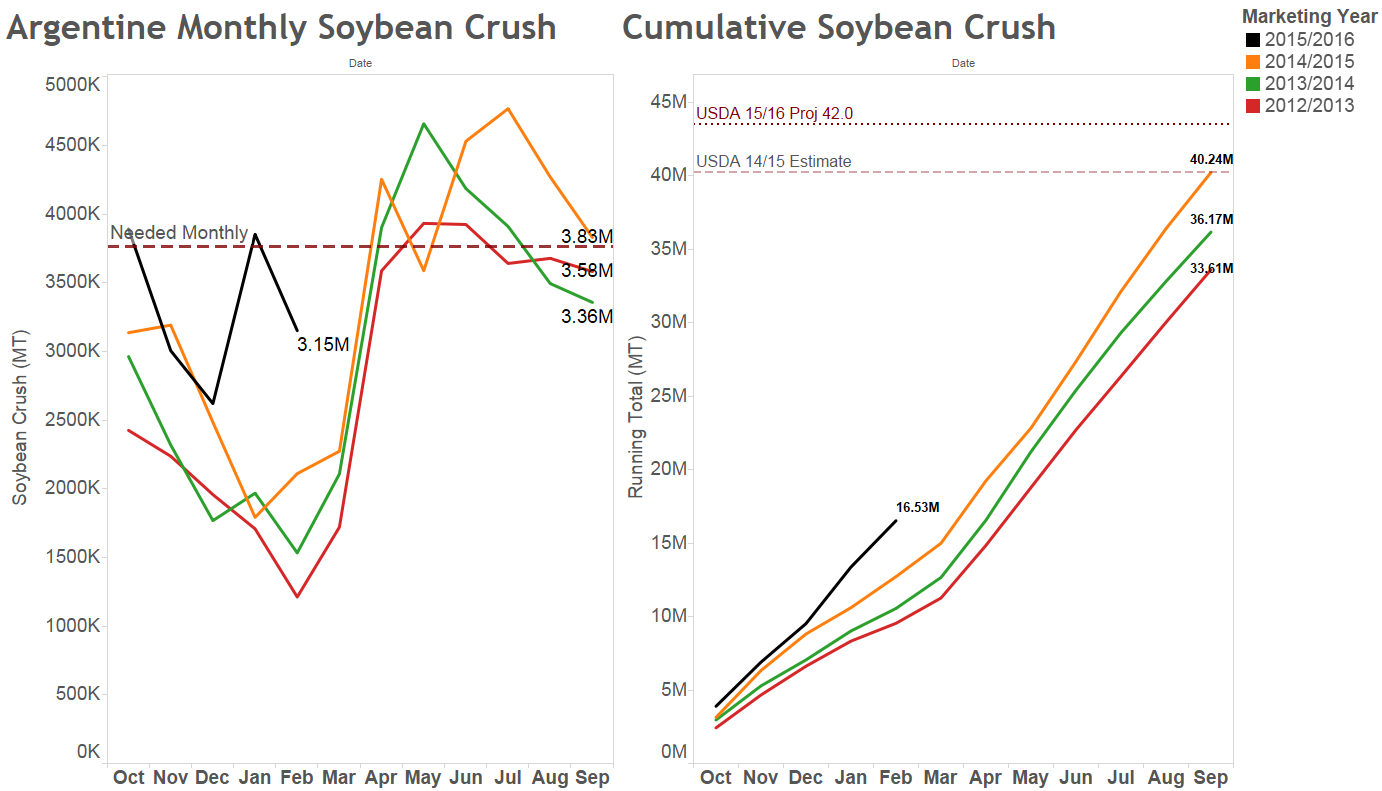

The current USDA estimate for Argentine crush was increased in each of the first 3 months of 2016 but was not changed on the April 12th report. In January 2016 it was increased 850k MT to 42.85 MMT, then again revised 650k MT higher in February, and then lastly increased 2200k MT in March to the current estimate. There haven’t been any changes to the 14/15 estimates since December of 2015

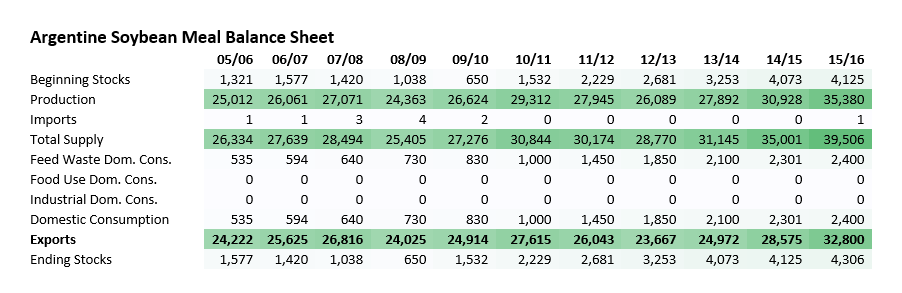

The current soybean meal balance sheet has beginning stocks of 4.125 MMT with meal production of 35.38 MMT. Domestic consumption of meal has been a small but growing part of overall demand and is up 140.0% over the past 5 years. Over that same time period soybean meal exports have grown 18.8%

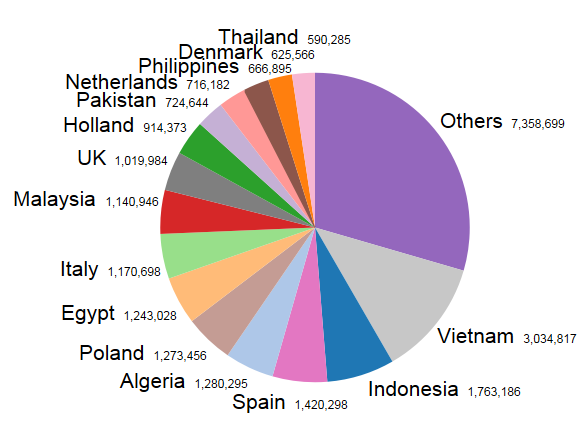

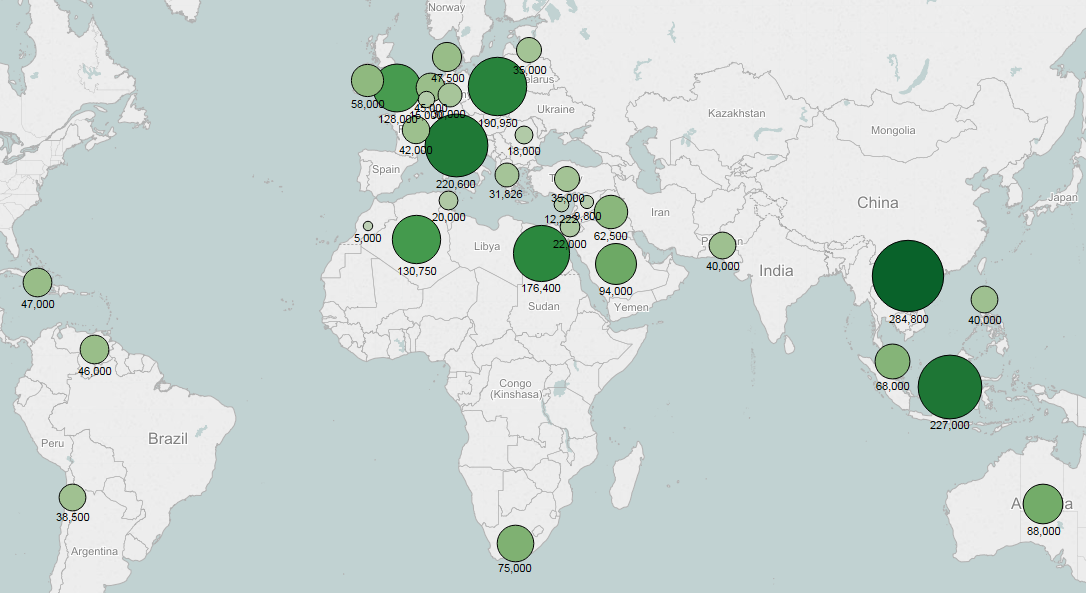

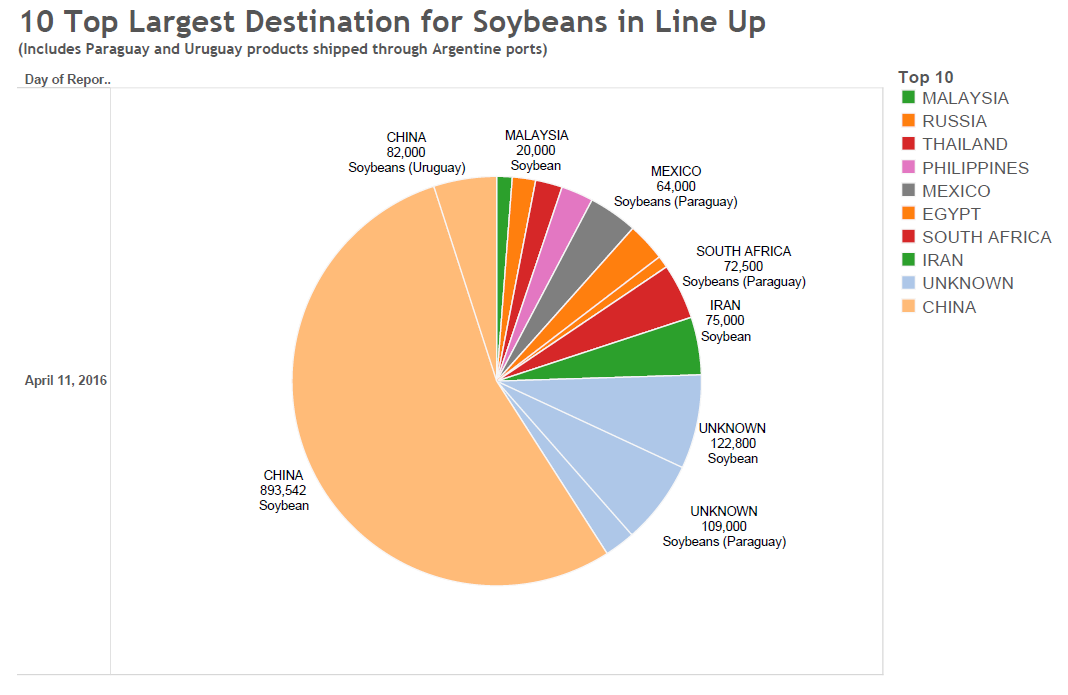

Argentine meal exports go to a diverse set of destinations (pie chart on right) including Europe and Southeast Asia. In 2015 the 10 largest destinations accounted for only 57.2% of total export volume and the 15 largest markets accounted for 70.5% according to numbers published by the National Food Safety and Quality Service (SENASA).

Additionally last year there were 67 countries Argentine shipped meal to where the volume was under 500k MT. Unlike soybean exports where China accounts for the majority of the volume, soybean meal exports in Argentina are spread out a wide range of countries doing relatively small volumes.

Current Crush Situation

Official crushing statistics are tracked by the Ministry of Agroindustry (Ministerio de Agroindustria) which publishes statistics for soybeans, sunflowers, peanuts, canola, and other oilseeds. Their reports also include the related production of oil, meals, and pellets.

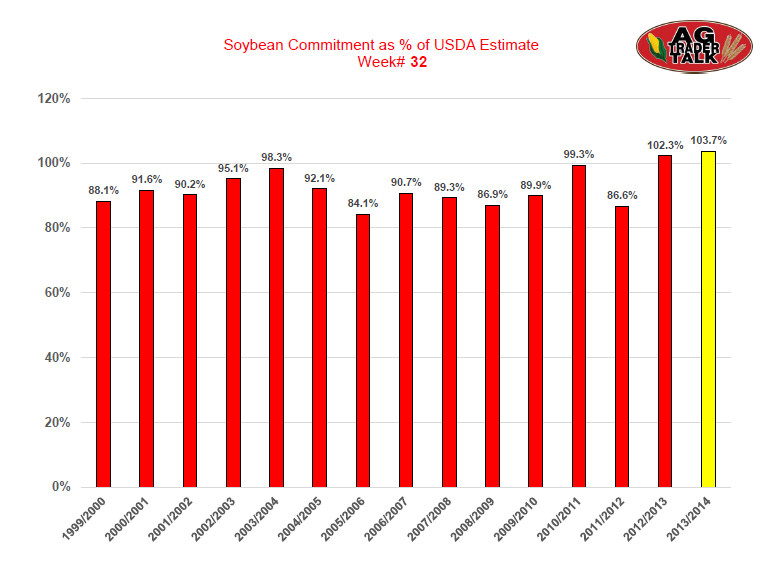

The USDA uses an October through September marketing year for soybeans in Argentina. The most recent data through February 2016 has marketing year total crush at 16.53 MMT which is up 30.0% compared to this time last year (12.72 MMT). This is currently the fastest pace of crush on record.

This record pace was helped by January’s crush total of 3.85 MMT after new president Mauricio Macri came to office in December 2015. Prior to 2016 the average crush pace in January was only 2.11 MMT with the prior record of 2.94 MMT set in 2008.

Crush in February was down slightly to 3.15 MMT but was still a record for the month exceeding the prior record of 2.27 MMT set in 2015. Previously the average crush rate in February was 1.78 MMT from 2003 through 2015.

Farmer Selling

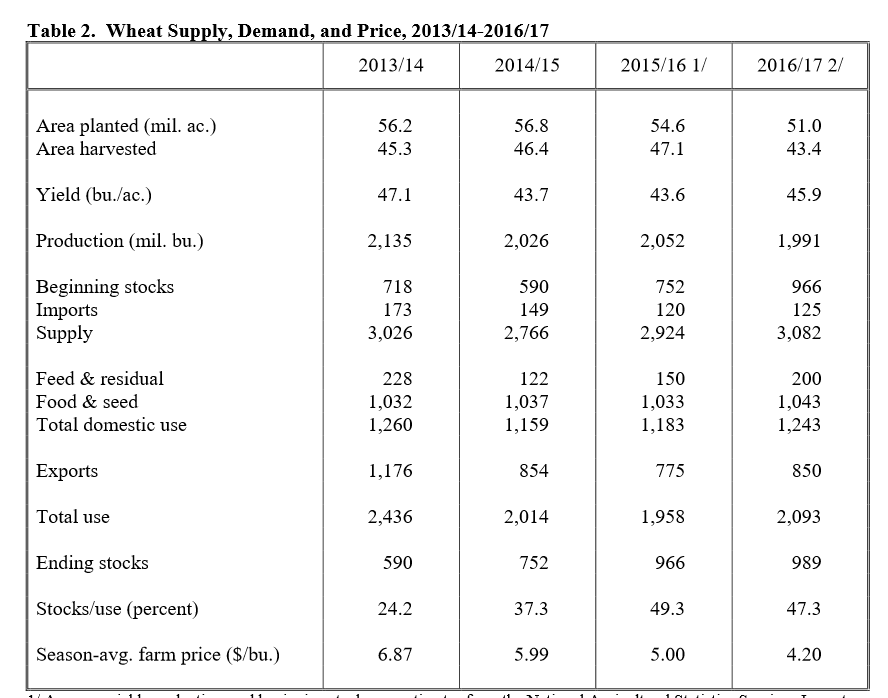

After Macri took office there have been new policies that benefited the agriculture sector including devaluation of the peso and eliminations of export taxes on wheat and corn. This led to substantial sales of corn and wheat although farmer selling of soybeans was less than the market anticipated.

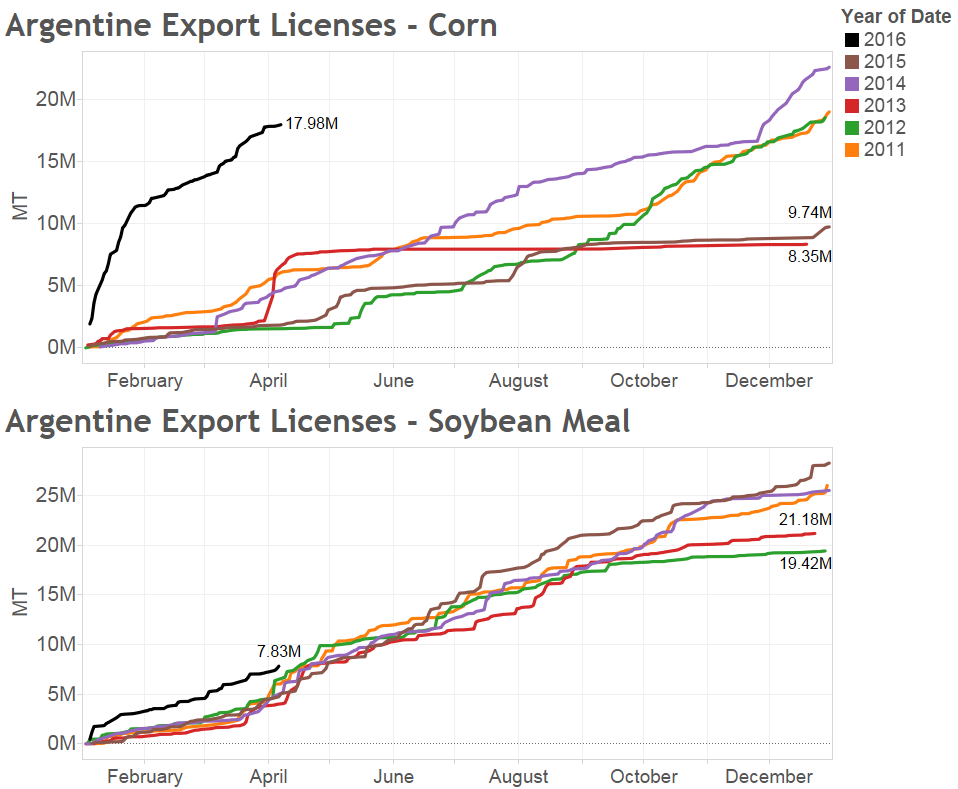

Since the removal of taxes the Ministry of Economy and Public Finance has issued export licenses at a record pace for some grains including 17.98 MMT of corn (top chart), 3.45 MMT of feed wheat and 1.77 MMT of barley.

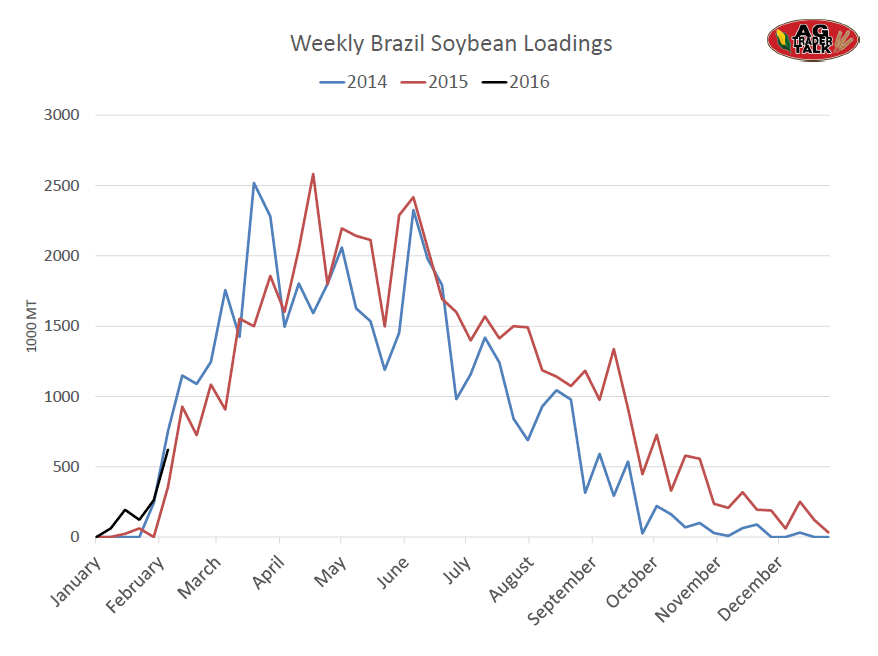

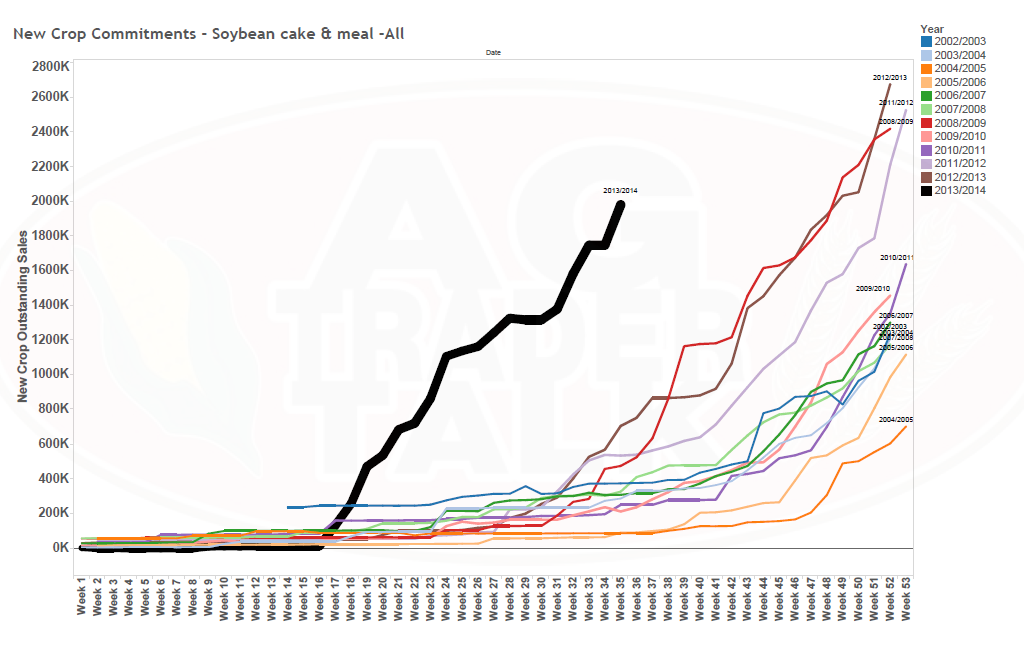

Export licenses of soybean meal are also at a record rate at 7.83 MMT for 2016 and 13.64 MMT since the start of the marketing year in October (lower chart). However compared to other grains the increase in export licenses is much smaller.

Soybean export licenses are at 2.74 MMT for the year which is about the same pace as 2014 and is below the 2012 pace.

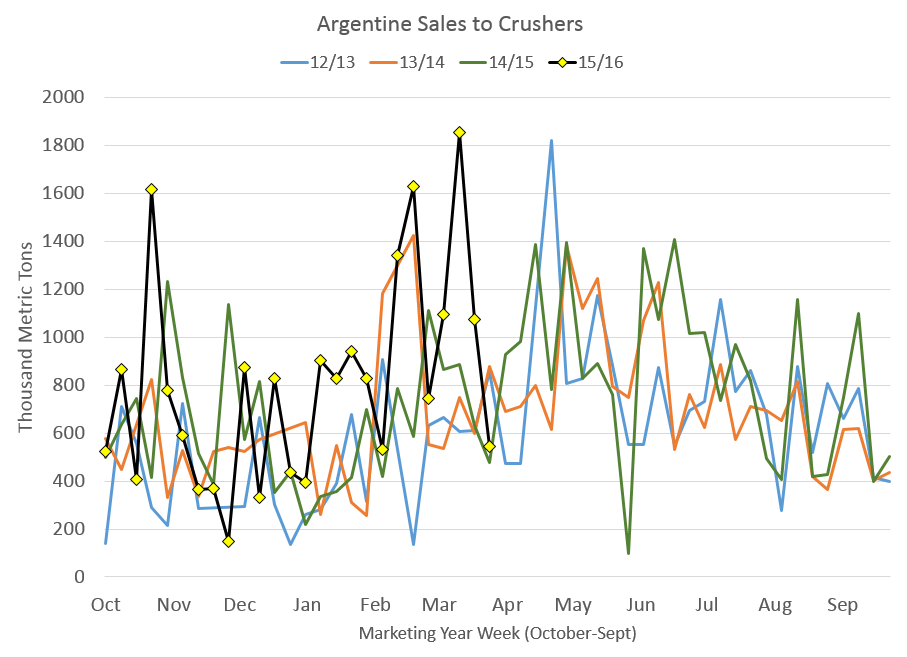

Despite these strong sales in grains the farmer sales of soybeans remained slow but have increased substantially in February and March. The Ministry of Agriculture also tracks soybean sales made to crushing facilities on a weekly basis. These are not as precise as the monthly official crushing statistics but provide an early estimate. Since the start of 2016 sales to crushers have averaged 977k MT per week.

The 15/16 marketing year total sales are now at 20.8 MMT which is up 27.3% compared to last year which was only 16.4 MMT at this time. Based on conversations with producers they were initially slow to sell soybeans and wanted to see how the new policies and reforms happened. It seems they are now more comfortable selling some soybean stocks.

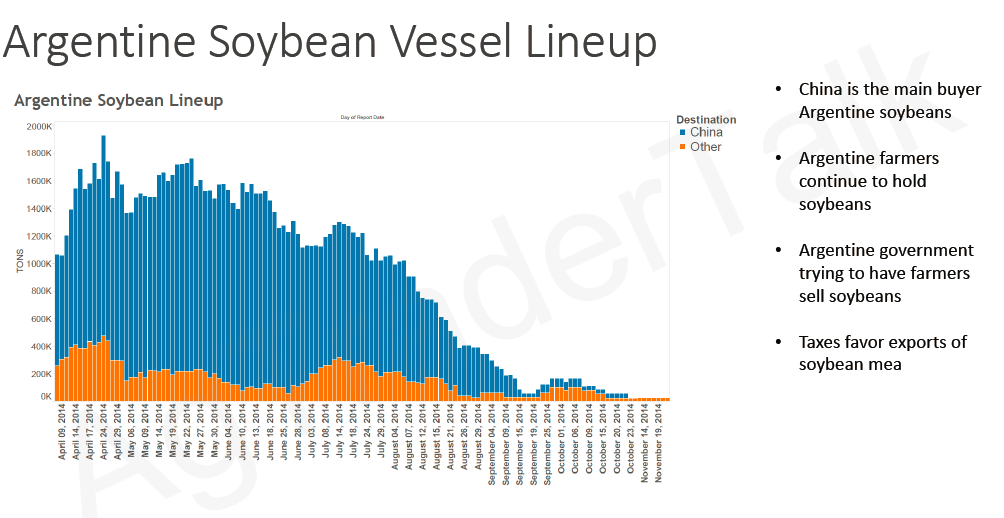

Vessel Lineup

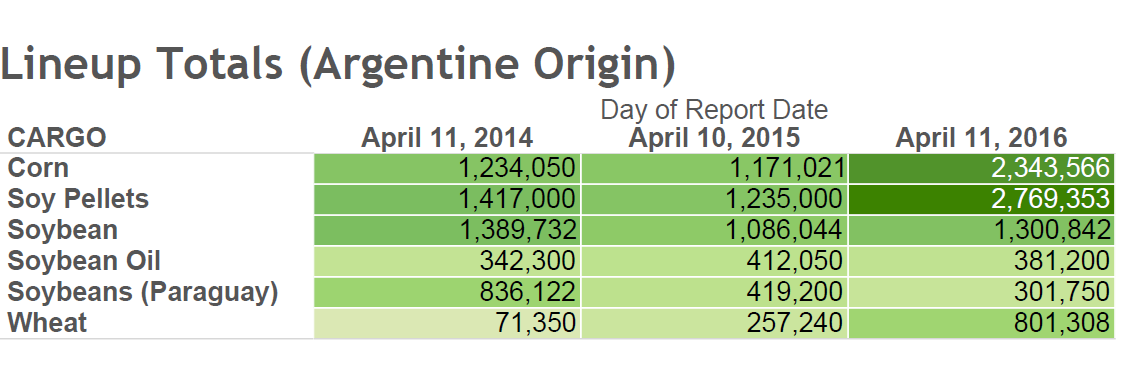

The current vessel lineup for Argentine includes 2.34 MMT of scheduled soybean meal and pellet shipments. This is substantially higher than last year at 1.17 MMT or even 2014 at 1.23 MMT. Additionally corn, wheat, soybean, and soybean oil scheduled shipments are all higher than 2015.

Meal shipments locations are shown in the map below by size and are currently scheduled for 33 destinations primarily in Europe, Southeast Asia and Middle East and North Africa. The 3 largest destinations are Vietnam, Indonesia, and Italy.

The lineup for whole, unprocessed soybeans from Argentina is at 1300k MT which is above 2015 levels but below 2014. Additionally there is 423k MT of soybeans from Paraguay and Uruguay scheduled to be shipped from ports in Argentina or Uruguay which brings the regional total to 1723k MT.

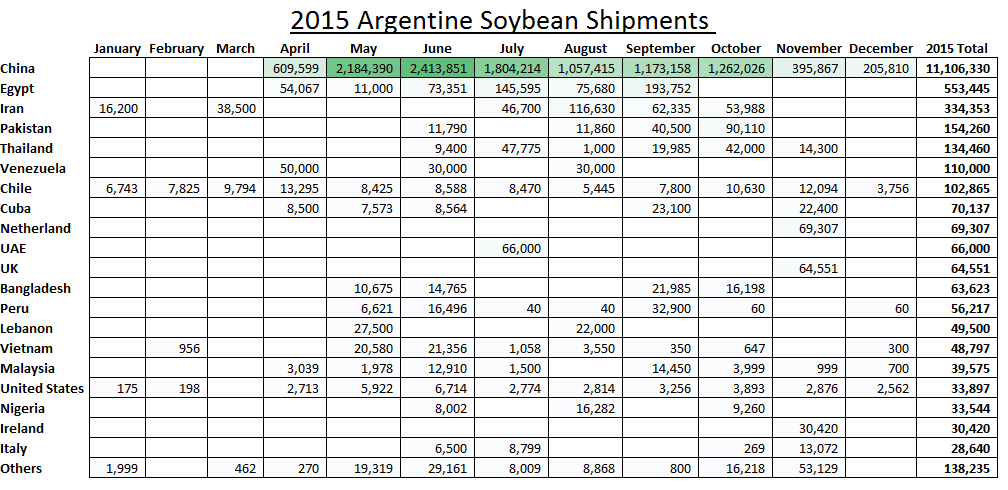

Of that total China accounts for 976k MT (59% of the total). The 2nd largest listed destinations is “Unknown” at 272k MT or 16% of the total. However this might be understating China’s role in whole soybean exports from Argentina. In calendar year 2015 China accounted for 11.11 MMT of the 13.29 MMT total soybean exports, or 83.6% of total soybean exports. The next largest destination was Egypt at only 553k MT.

Of that total China accounts for 976k MT (59% of the total). The 2nd largest listed destinations is “Unknown” at 272k MT or 16% of the total. However this might be understating China’s role in whole soybean exports from Argentina. In calendar year 2015 China accounted for 11.11 MMT of the 13.29 MMT total soybean exports, or 83.6% of total soybean exports. The next largest destination was Egypt at only 553k MT.

FOB Premiums

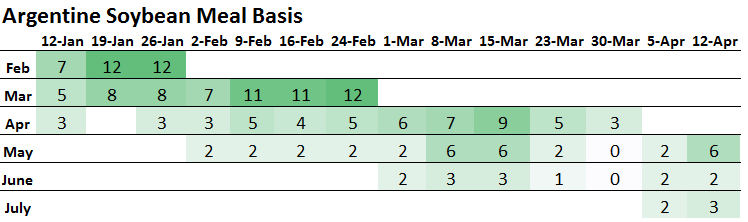

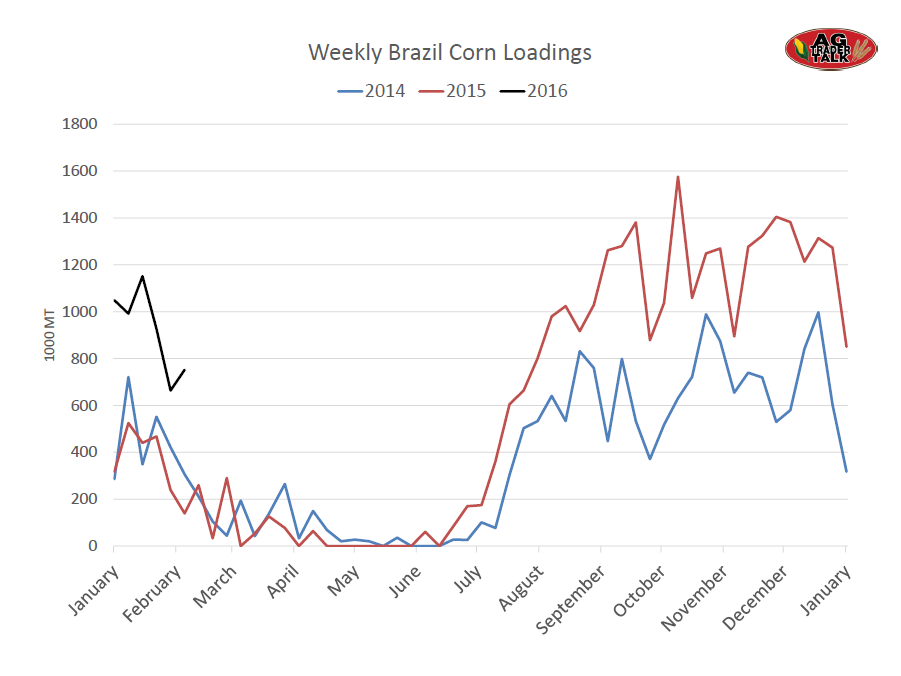

Argentine FOB premiums for soybean meal have fallen as the harvest began. Premiums are lower than last year at this time where most months were around $8-9/ton premium to CBOT prices compared to $2-6/ton now. However it’s notable that during March and April the Brazilian meal basis has fallen dramatically more than Argentina. Currently Brazil is around -$30/ton for May and -$20/ton for June.

Going Forward

- USDA is forecasting 15/16 ending stocks at 29.3 MMT which is down 2.4 MMT but is still the 2nd largest Argentine stocks on record. This seems like relatively small stocks liquidation given the large pre-harvest sales to crushers. Will farmers liquidate more than expected if they switch away from soybeans?

- Argentine crush capacity is estimated at 60 MMT per year. The current forecast of 45.7 MMT is a record but is still only 76% of capacity. Will Argentina be able to expand crushing toward capacity or will it be limited by logistics and shipping issues?

- If old stocks are liquidated could this cause quality issues with buyers? Government crushing data suggests meal yields are on the low end of the historic range. Will this remain low if stocks are liquidated?