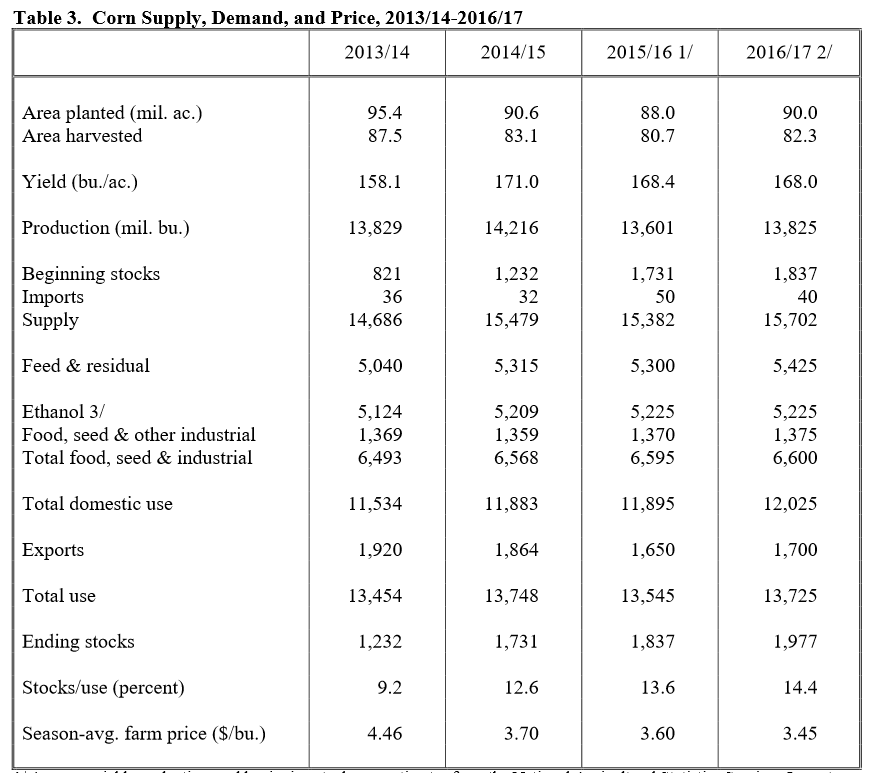

Corn:

USDA forecasting a 2% increase in production Y/Y with their trendline yield of 168.0 bpa. Exports seen up 3% Y/Y (+50 mbu) while total demand up 1% Y/Y, largely coming on 125 mbu increase in feed/residual (+2%). Livestock production would likely need to see larger expansion than currently seen? At face value, if BRZ doesn’t have a weather event in corn, exports could still be overstated. Secondary prize for not posting a 2 bil bushel carryout. Am sure the feed/residual numbers will find arguments as to being too big. Analysts so far are running around 25 mbu less on F&R than USDA is but that being said, trade is also using a larger export number (1.750 bbu).

14.4% stocks to use in corn would be largest since 17.45% in 2005/06.

Bottom line, USDA fairly aggressive on demand but they’re also assuming lower prices (cure for low prices is low prices). At 90 mil acres, fairly similar yield returns as last year, means carryout increases largely depend on lack of summer northern hemisphere weather event.

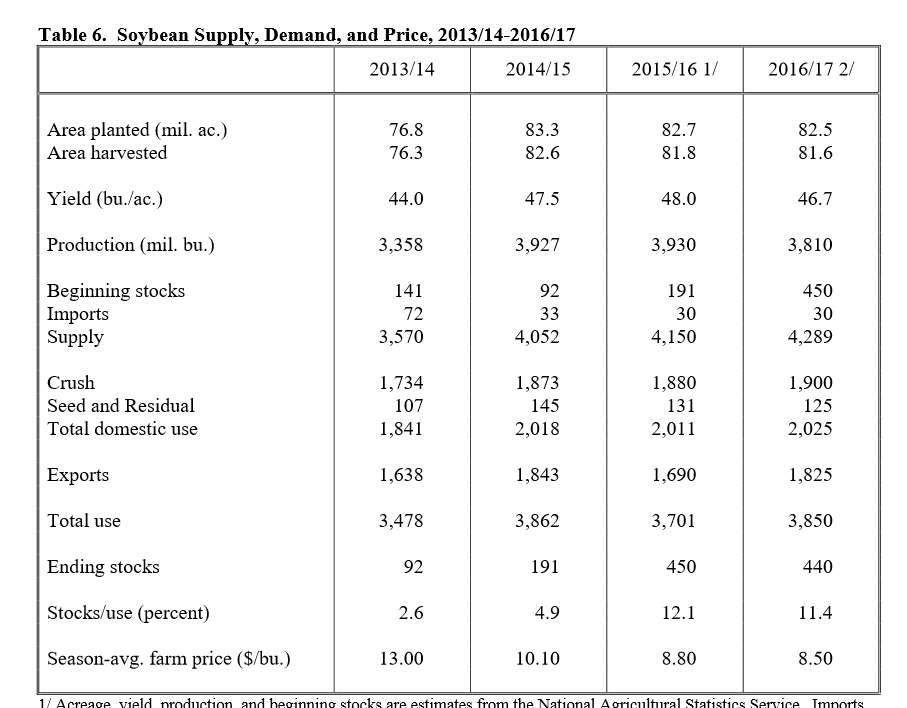

Soybeans:

Trendline yield of 46.7 bpa; production down 3% Y/Y. USDA has crush at 1.900 bbu (trade at 1.890 on avg); exports at 1.825 bbu (trade: 1.777) with demand at 3.850 bbu (trade 3.799) up 4% Y/Y which may seem aggressive given lack of issues in SA. Y/Y decline in stocks/use at 11.4%.

In beans, aggressive demand estimates and Y/Y declines in carryout but tendency could be for more bean acres (where do wheat acres go if they go?). If acres are found back, then soybean S&Ds have potential to get very sloppy. Gut hunch is that bean yield has better potential to beat trend than corn but that isn’t saying much, and still have to be cognizant of potential late summer weather situation.

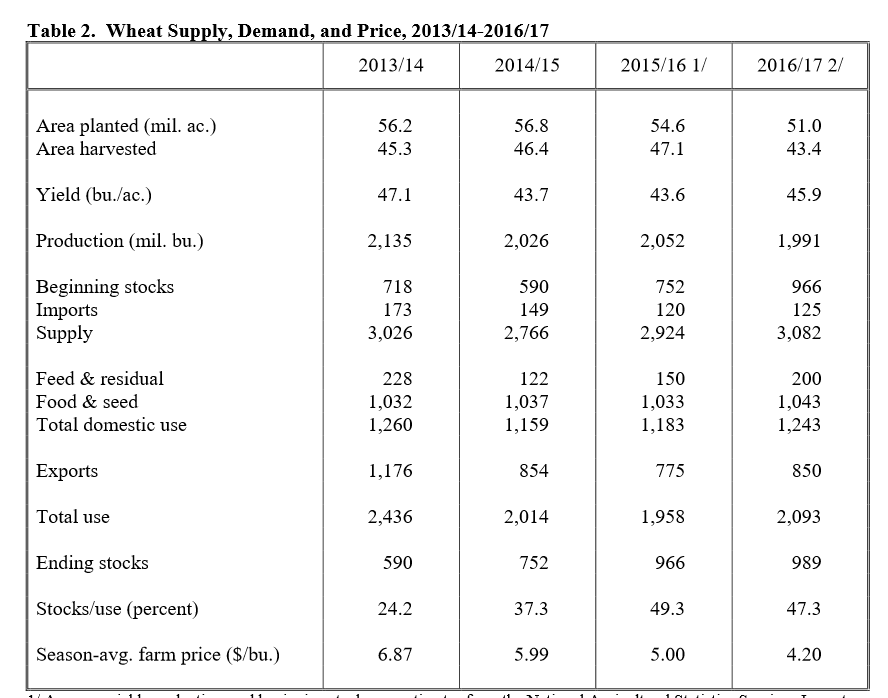

Wheat:

USDA forecasting a 7% Y/Y increase in total demand of which, a 10% Y/Y increase in exports at 850 mbu (note in the what other’s email trade averaged 885 mbu exports) while USDA is more aggressive on feed residual (200 mbu vs trade’s 175 mbu).

47.3% stocks/use down slightly Y/Y. Would be 9th largest since 1970.